Aada Finance to Leverage Aiken for V2 Mainnet Launch

Aada Finance has played an integral role in decentralized finance (DeFi) on the Cardano blockchain since September 2022. Now, we are gearing up for the launch of V2, which will introduce new peer-to-pool mechanics to drive adoption further.

Aada Finance has played an integral role in decentralized finance (DeFi) on the Cardano blockchain since September 2022. Now, we are gearing up for the launch of V2, which will introduce new peer-to-pool mechanics to drive adoption further. But what’s even more unique is that we will leverage the power of Aiken, a programming language and toolkit for smart contract development on Cardano. In this article, we will take a closer look at the unique features of V2 and how Aiken is helping to make smart contract development on Cardano more efficient and accessible.

Leveraging the Power of Aiken onto V2

While the V1 garnered significant interest in the Cardano community, Aada Finance plans to drive adoption further with the launch of V2. The upcoming upgrade will implement peer-to-pool mechanics while leveraging the merits of Aiken. The new version will allow users to deposit and borrow funds in dedicated pools, increasing fund liquidity and availability. Here are some first impressions of the smart contract design:

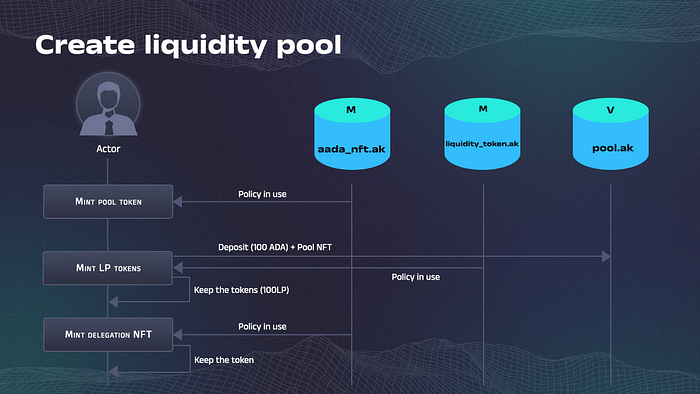

Pool Creation

The peer-to-pool design is one of the unique features that V2 will present to the ecosystem. It will enable anyone to create a pool by depositing a selected native token (e.g., ADA or AADA). In return, the smart contract will mint two NFTs:

- An NFT that verifies pool ownership;

- A delegation NFT (necessary to delegate the pool to an SPO);

Each pool will employ dynamic APR for deposits while creating a genuine and open pool market. In turn, borrowers will be able to:

- Pay fixed interest depending on the time of taking the loan

- Pay different interest for the same loan/collateral positions

Since the Stake part of the contract address is parameterized, the pool NFT policy will help track all Aada Pools.

Interesting fact: The Staking smart contract is the size of 4kb and does 2 validation functions. The Pool smart contract is the size of 7kb and executes ~30 validation functions. The estimated improvement that Aiken delivers is 7 times smaller transactions.

Interest Rates

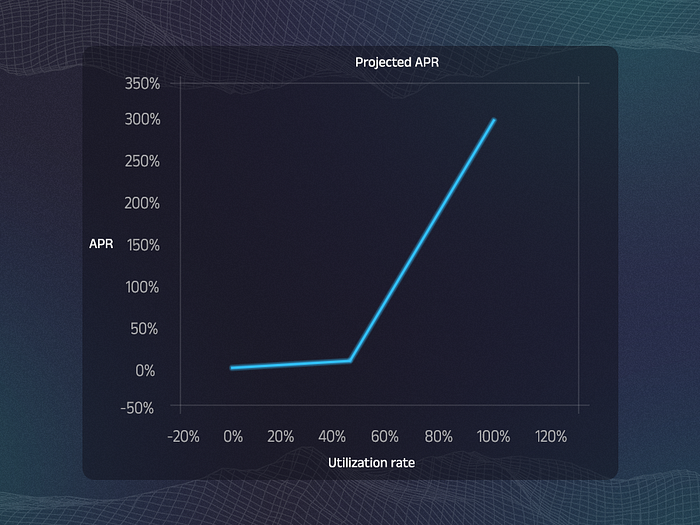

Interest rates on Aada V2 will reuse what Aave does regarding algorithms and rates. In simple terms, interest rates will increase slowly until a utilization rate of 45%. Surpassing the underlying percentage will trigger a sharp increase in the projected APR, as shown below:

That way, the protocol will encourage borrowing when the demand is low. Meanwhile, a higher demand will produce higher interest rates, incentivizing more lenders to deposit. Note that the minimum interest rate is 2%, a reiteration of a DAO proposal regarding the minimum interest vesting threshold for V1 loans.

Conclusion

The introduction of V2 will impose zero dependencies on third parties, ensuring an immutable and permissionless operation. With the power of Aiken, Aada Finance will allow users to interact with the protocol’s smart contracts efficiently and in a trustless manner. The end goal is genuine decentralization without kill switches.

About Aiken

Aiken is a programming language and toolkit incubated by TxPipe, aiming to provide a robust and efficient smart contract development experience for the Cardano blockchain. Its primary feature is the ability to target Untyped Plutus Core (UPLC), often called simply Plutus.

By introducing a new framework for compiling to UPLC, Aiken delivers an alternative smart contract language compatible with Cardano’s smart contract virtual machine. Ultimately, it delivers modular simplicity similar to Ethereum’s Solidity. You can learn more about Aiken at https://aiken-lang.org/.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!