Aada Finance to Kick off Liquidity Mining and Staking Incentives

Aada Finance proudly announces a new milestone on its path to shine a light on the Cardano DeFi. Indeed, we are ready to take the next step towards a full protocol launch by providing liquidity mining and staking.

Aada Finance proudly announces a new milestone on its path to shine a light on the Cardano DeFi. Indeed, we are ready to take the next step towards a full protocol launch by providing liquidity mining and staking.

The event will take place at the beginning of March and will be available on SundaeSwap and Aada Finance dApp. All supporters who use the following features will receive AADA tokens as rewards.

Liquidity Pool Mining

As previously stated, one of our core goals is to establish close relationships with all teams from the Cardano ecosystem. That’s why we’re excited to continue our collaboration with SundaeSwap. Apart from the trading fee rewards, users providing liquidity in the AADA/ADA pool will receive AADA tokens.

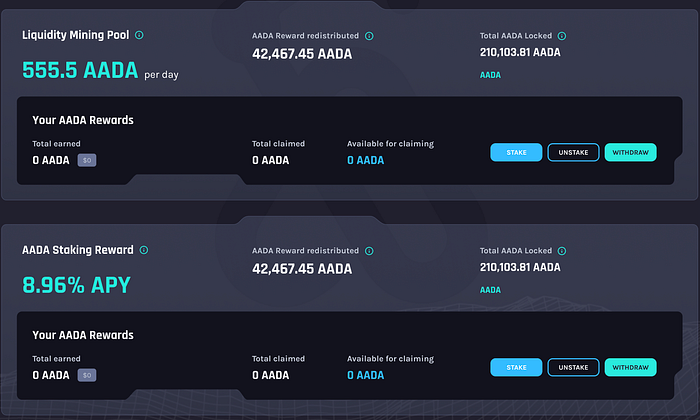

As part of our Yield Farming incentive, we will provide a total of 100,000 AADA over the first six months. In other words, Liquidity Providers will receive 555.5 AADA a day in correspondence with their LP tokens’ amount and/or value. Here’s a more detailed breakdown of how SundaeSwap’s AADA/ADA Yield Farming will work:

1. All Liquidity Providers who provide pair of AADA/ADA on SundaeSwap receive LP tokens in the form of rewards for depositing the pair assets into the pool.

2. Suppose the received LP tokens are eligible for the particular pool. In that case, the Liquidity Providers will stake their assets in the Yield Farming contract. Consequently, they will qualify for additional yield on top of the fees they accrue for providing liquidity on SundaeSwap.

3. Rewards for Liquidity Providers will accumulate every 30 days, the initial funds will not be locked. If a user takes out his staked asset before distribution period, his accumulated rewards will be lost.

4. Users may withdraw their rewards at the end of each yield contract term (the 30-day yield period). Also, they can remove any additional rewards earned from the qualified pool. Early withdrawal will result in no yield farming rewards earned for the current term. Doing so from a rolled-over period will not invalidate any yield earned from completed earlier conditions.

5. Users will be able to stake or unstake at any time, there is no limitation or restriction to migrate LP tokens.

How to provide liquidity on SundaeSwap.

Disclaimer: Keep in mind that liquidity mining poses a risk of impermanent loss. Aada Finance is not liable for any price fluctuations that may cause financial losses.

Staking on the Aada Finance DApp

The second part of our incentive program will serve as a pre-launch event for the Aada Finance lending protocol. As expected, it will allow supporters to stake AADA tokens and earn more according to the deposited amount. The feature will roll out as part of our roadmap, which you can check out in our Aada Finance GitBook.

Initially, we introduce AADA staking feature with a 8.96% APY to reward our supporters. If you’re looking for a safer way to earn more AADA, you can use the AADA tokens and stake them on Aada Finance. That way, you’ll receive more AADA without the risk of impermanent loss.

AADA staking will be without lock period, rewards or initial deposit can be withdrawn daily.

Conclusion

In conclusion, Aada Finance is set to introduce new incentives for the project’s long-term supporters. Users will earn AADA through staking through our native dApp. Also, we will provide 555,5 AADA daily rewards to SundaeSwap’s AADA/ADA liquidity pool.

Arguably, the act shows our dedication to the Cardano ecosystem and the Aada Finance community. In this regard, both milestones fully correspond with our roadmap as we plan to continue reaching new heights. Finally, you can learn more about our other events here:

Useful Information

- Public Sale tokens swap will be live today (February 10th), you can swap your Proof-of-Purchase receipts here.

- Users who still own AADA v1 can use the Aada Finance swap to barter their old tokens for AADA v2. The exchange rate for all AADA v2 is 1:1.

- To participate in the Aada Finance ISPO, delegate your ADA to “ISPO — Aada Finance — Stake ADA earn AADA”. Make sure the stake pool has a [ISPO] ticker. Learn how to become an active delegator here.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!