A Regulatory Squeeze

A common narrative you hear in crypto is that regulatory clarity will cause institutional investors to flood into the space. It’s often cited as the trigger for the next bull run. However, each time news of regulations hits the headlines markets plummet, and last week’s settlement between the SEC and Kraken was no exception.

A common narrative you hear in crypto is that regulatory clarity will cause institutional investors to flood into the space. It’s often cited as the trigger for the next bull run. However, each time news of regulations hits the headlines markets plummet, and last week’s settlement between the SEC and Kraken was no exception.

While it’s true that forward-thinking regulations will help to remove a lot of uncertainty from the space, it’s doubtful it will cause the next bull run. As we’ve seen from the present market conditions several larger factors such as Russia and China have more influence on price than regulations.

The reason for the narrative is that liquidity is required to drive prices back up to all-time highs and there’s presently a global liquidity crunch affecting all markets. Even if Gary Gensler at the SEC came out with clear and precise wording for future regulations it’s unlikely this would do anything other than cause a short-term pump.

On the other hand, each time the SEC files charges against anyone in crypto or reaches a settlement with them this causes prices to tank. The reason for markets dropping value on this news is that it’s the worst kind of clarity, it’s regulation through litigation.

Although the process of complying with regulations will be somewhat onerous and expensive this is nothing compared to the almost limitless liability of being sued by the SEC. Institutions are rightly cautious of this approach and that’s why every time it happens crypto portfolios suffer.

What’s stopping the SEC and other regulators from providing clarity is that they are seeking to actively slow down the adoption of blockchain technology to give the regulated financial sector time to catch up. Government agencies are old institutions with ongoing relationships with the financial services sector and they work together to try and stabilize markets.

Although this is often presented as a conspiracy between a cabal of global elites to try and prevent the public from benefiting from crypto, the reality is that the global financial system is vulnerable to systemic shocks and risks. The reason for stifling adoption is that the transition to a new monetary technology is fraught with danger.

The good news is that there are signs that a growing number of politicians in the US are becoming frustrated with the time it’s taking to develop clarity with crypto. While the SEC is choosing to use the threat of lawsuits to try and slow innovation in the sector it’s instead causing more projects to move to other countries.

Clarity is one factor, but the content of regulations is far more important. For instance, the European Parliament have been very clear about the direction they’re headed with crypto legislation, but because this is so draconian it’s pushed many projects away from the region.

The UK is starting to recognize the opportunity the present situation is giving them to gain a valuable foothold in blockchain technology. They understand the UK needs to be more amenable to the needs of projects than the EU and the US if it wants to attract them to its shores.

Regulators and politicians are starting to understand that their traditional approach to controlling financial technology is no longer effective in such a globalized world. No matter how they seek to threaten or control the technology it can be offshored in a matter of moments.

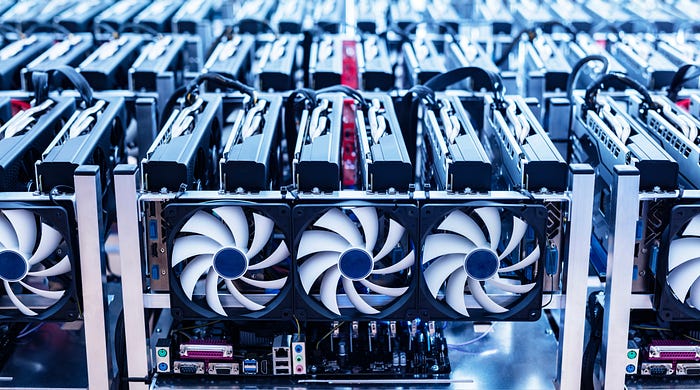

We This was shown in 2021 when China banned Bitcoin mining and all cryptocurrency trading. Bitcoin’s hashrate plummeted along with the value of tokens, yet a few months later its hashrate was even higher than before the ban and prices had fully recovered.

Some countries are beginning to realize that trying to ban crypto is not only ineffective but also causes them to miss out on the opportunity to grow their own economies. Those that welcome crypto developers and look to the future are the ones that will benefit the most from the present indecision.

If the current situation with regulation through litigation continues it’s highly likely that a major economy will step into the space this creates. With the damage that Covid and inflation have caused to so many economies, it’s only a matter of time before one of them breaks ranks and capitalizes on the opportunity.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!