A Beginner’s Guide to Crypto Passive Income Through Index Funds and ETFs

What Are Crypto Index Funds and ETFs, and How Do They Work?How Do Crypto Index Funds and ETFs Work?Where These Products Are Traded and ManagedBenefits of Using Index Funds and ETFs for Passive...

Crypto passive income refers to earning money from your crypto assets without the need for constant trading or active management. It’s a popular strategy for investors who want long-term exposure to digital assets while minimizing effort and risk.

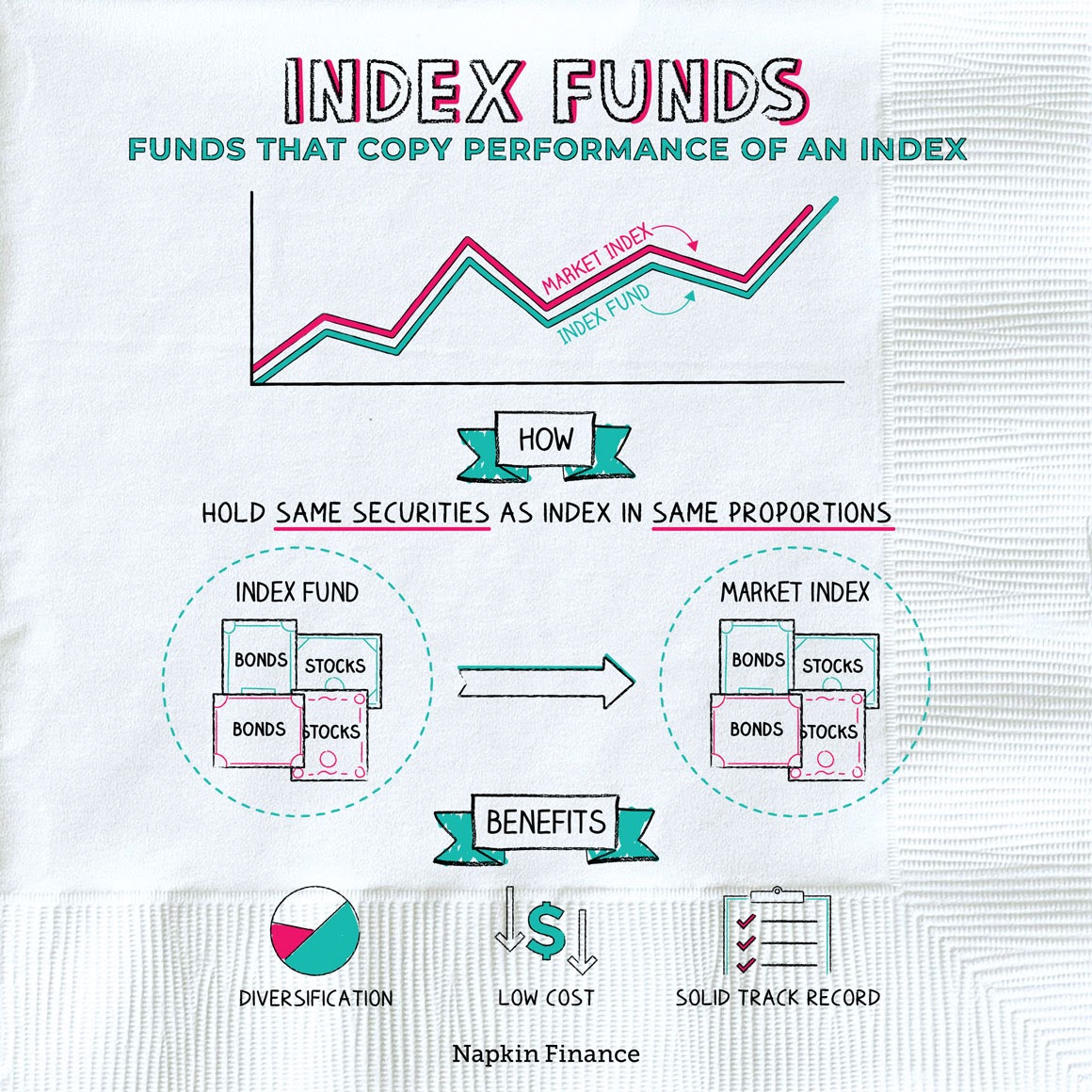

For beginners, crypto index funds and exchange-traded funds (ETFs) offer one of the simplest entry points. These investment vehicles pool together a variety of cryptocurrencies, similar to how traditional index funds work with stocks, so you get diversified exposure without having to pick individual coins.

In this guide, we’ll break down how crypto index funds and ETFs work, the benefits and risks, popular platforms to get started, and tips for maximizing your passive income potential.

What Are Crypto Index Funds and ETFs, and How Do They Work?

Crypto Index Funds are pooled investment products that include a mix of cryptocurrencies, designed to track the performance of a specific part of the crypto market, like large-cap coins, DeFi tokens, or the overall crypto market.

Instead of buying individual coins, investors buy shares in the fund, which automatically gives them exposure to multiple assets. This helps reduce risk through diversification and offers a hands-off way to invest.

For example, a crypto index fund might hold Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and Cardano (ADA), weighted by market cap. As the value of these coins changes, so does the value of the fund.

Crypto ETFs (Exchange-Traded Funds) work similarly, but they are traded on traditional stock exchanges like any regular ETF. These funds aim to mirror the price of a specific cryptocurrency or a basket of digital assets. Some ETFs are physically backed (holding the actual crypto), while others are futures-based (tracking the price via contracts).

How Do Crypto Index Funds and ETFs Work?

Most crypto index funds and ETFs are market-cap weighted, meaning larger cryptocurrencies like Bitcoin and Ethereum make up a bigger portion of the fund than smaller ones. This mirrors the actual size and influence of each asset in the market.

To keep the portfolio aligned with the market, these funds are often rebalanced regularly, usually monthly or quarterly. Rebalancing means adjusting the weights of the assets in the fund so they reflect updated market conditions. For example, if Solana grows rapidly in market cap, its share in the index may increase during the next rebalance.

Where These Products Are Traded and Managed

- Crypto Index Funds are typically offered through platforms like Bitwise, TokenSets, or Crypto20, and may require direct crypto purchases or wallets.

- Crypto ETFs are traded on traditional stock exchanges, like the NYSE or CBOE, through platforms such as Fidelity, Charles Schwab, Robinhood, or eToro. These ETFs can be purchased just like a stock using a brokerage account; no need for a crypto wallet.

For example, if you want to invest $100 in the iShares Bitcoin Trust ETF (IBIT) using a platform like Robinhood or Fidelity.

- Step 1: Open an account with your chosen brokerage.

- Step 2: Search for the crypto ETF ticker (e.g., “IBIT”).

- Step 3: Choose how many shares you want or invest a dollar amount.

- Step 4: Confirm the purchase.

If IBIT is trading at $10 per share, your $100 investment buys you 10 shares. As Bitcoin’s price moves, the ETF price and your investment go up or down accordingly.

Benefits of Using Index Funds and ETFs for Passive Income

Crypto index funds and ETFs offer several unique advantages that make them ideal for beginners looking to earn passive income without getting overwhelmed by the complexity of the crypto market.

Benefits of Using Index Funds and ETFs for Passive Income

- Diversification: Lower Risk Than Single Coin Exposure

- Ease of Use: No Need for Active Trading or Deep Technical Knowledge

- Long-Term Growth: Capture Broad Market Upside

- Auto-Rebalancing: Portfolio Management Done for You

Diversification: Lower Risk Than Single Coin Exposure

One of the biggest benefits of index funds and crypto ETFs is built-in diversification. Instead of betting everything on one coin, like Bitcoin or Ethereum, you get exposure to a broad mix of cryptocurrencies. This helps reduce risk, since gains in others can balance out poor performance from one asset. It’s a safer way to invest in the often-volatile world of crypto.

Ease of Use: No Need for Active Trading or Deep Technical Knowledge

You don’t need to be a blockchain expert or monitor charts all day. Index funds and crypto ETFs are designed to be user-friendly. Most platforms handle everything, from portfolio selection to rebalancing, so you can invest with confidence even if you’re new to crypto or investing in general.

Long-Term Growth: Capture Broad Market Upside

Instead of chasing the next big coin, index funds and ETFs let you benefit from the overall growth of the crypto sector. As the market matures and adoption grows, your diversified portfolio is positioned to grow with it, without needing to buy and sell individual assets constantly.

Auto-Rebalancing: Portfolio Management Done for You

Many crypto index funds and ETFs are automatically rebalanced on a set schedule, monthly or quarterly. This means your holdings are adjusted based on changes in the market, like shifts in coin value or market cap. Auto-rebalancing keeps your portfolio aligned with current trends and reduces the need for manual management.

Risks and Considerations

While crypto index funds and ETFs offer convenience and diversification, they aren’t risk-free. Understanding the potential downsides is essential for making informed decisions.

Risks and Considerations

- Market Volatility Still Applies

- Management Fees and Platform Charges

- Liquidity and Slippage for Some ETFs

- Regulatory Uncertainty Depending on Region

Market Volatility Still Applies

Even though these funds spread risk across multiple assets, they’re still exposed to the overall ups and downs of the crypto market. If the broader market takes a hit, your investment could lose value, even if you’re not directly holding individual coins.

Management Fees and Platform Charges

Most index funds and crypto ETFs come with expense ratios or management fees. These costs are typically small (e.g., 0.5%–2% annually), but they can add up over time and eat into your returns. Some platforms may also charge transaction or account maintenance fees.

Liquidity and Slippage for Some ETFs

Not all crypto ETFs have high daily trading volume. This can lead to liquidity issues or price slippage when buying or selling shares, especially for newer or niche ETFs. Low liquidity may mean you can’t exit your position quickly without impacting the price.

Regulatory Uncertainty Depending on Region

The regulatory environment for crypto investments is still evolving. Some crypto ETFs may not be available in certain countries due to legal restrictions, and future regulation could impact how these products are structured or offered. Investors should stay updated on the rules in their region to avoid surprises.

READ ALSO: ETFs May Not Be the Boon for the Ecosystem as Some Believe

Tips for Beginners to Maximize Passive Income

To get the most out of your crypto index fund or ETF investments, it’s important to go beyond simply buying and holding. These tips can help you enhance returns while keeping risks under control.

Tips for Beginners to Maximize Passive Income

- Choose Well-Rated, Low-Fee Funds

- Use Dollar-Cost Averaging (DCA)

- Diversify Across Multiple Funds or Sectors

- Combine with Other Passive Income Strategies

- Stay Informed on Regulatory and Fund Changes

- Evaluate Underlying Asset Exposure Regularly

- Reinvest Your Earnings Automatically

1. Choose Well-Rated, Low-Fee Funds

Management fees and expense ratios directly affect your returns. Aim for reputable funds with transparent, low-cost structures. A fund with a 1% annual fee may seem minor, but over time, it can significantly reduce your compounded earnings, especially in down markets.

2. Use Dollar-Cost Averaging (DCA)

Rather than trying to time the market, consider investing a fixed amount at regular intervals (e.g., weekly or monthly). This strategy helps reduce the impact of short-term volatility and builds your position gradually, especially useful in a volatile market like crypto.

3. Diversify Across Multiple Funds or Sectors

Avoid putting all your money into a single fund. Instead, consider diversifying across funds that track different areas of the crypto ecosystem, such as Layer-1 blockchains, DeFi tokens, or metaverse projects. This spreads your risk and exposes you to various growth trends.

4. Combine with Other Passive Income Strategies

Crypto ETFs and index funds are only one path to passive income. You can enhance your overall yield by also exploring staking, lending, or yield-bearing stablecoins. Just be sure each strategy aligns with your risk tolerance and investment horizon.

5. Stay Informed on Regulatory and Fund Changes

The crypto industry evolves quickly, and so do the regulations and policies that affect crypto ETFs and funds. Subscribe to fund updates, review prospectuses, and keep an eye on your local crypto laws. This ensures your investments remain compliant and strategically sound.

6. Evaluate Underlying Asset Exposure Regularly

Not all funds disclose full transparency of holdings or updates in real time. Review fund documentation or third-party trackers to ensure the assets still align with your beliefs (e.g., avoiding tokens you find too risky or preferring greener blockchain projects). This ensures your investment stays mission-aligned and up to date.

7. Reinvest Your Earnings Automatically

If your fund pays out returns (such as from futures-based ETFs or staking index tokens), consider enabling automatic reinvestment. This boosts compounding, allowing your earnings to generate their own income over time, a key strategy for long-term wealth building.

Final Thoughts

Starting your journey with crypto passive income through index funds and ETFs doesn’t have to be overwhelming. Begin slowly, invest what you’re comfortable with, and take the time to research each fund thoroughly. Understanding the assets you’re exposed to and the risks involved is key to making smart, long-term decisions.

Remember, passive investing doesn’t mean you stop learning or monitoring your investments. Staying informed about market trends, regulatory changes, and fund updates will help you adapt and optimize your strategy over time. With patience and knowledge, crypto index funds and ETFs can be powerful tools for building steady passive income in the evolving digital asset space.

Disclaimer: This article is intended solely for informational purposes and should not be considered trading or investment advice. Nothing herein should be construed as financial, legal, or tax advice. Trading or investing in cryptocurrencies carries a considerable risk of financial loss. Always conduct due diligence.

If you would like to read more articles like this, visit DeFi Planet and follow us on Twitter, LinkedIn, Facebook, Instagram, and CoinMarketCap Community.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Don't miss out!

Subscribe To Our Newsletter

Give it a try. You can unsubscribe at any time.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!