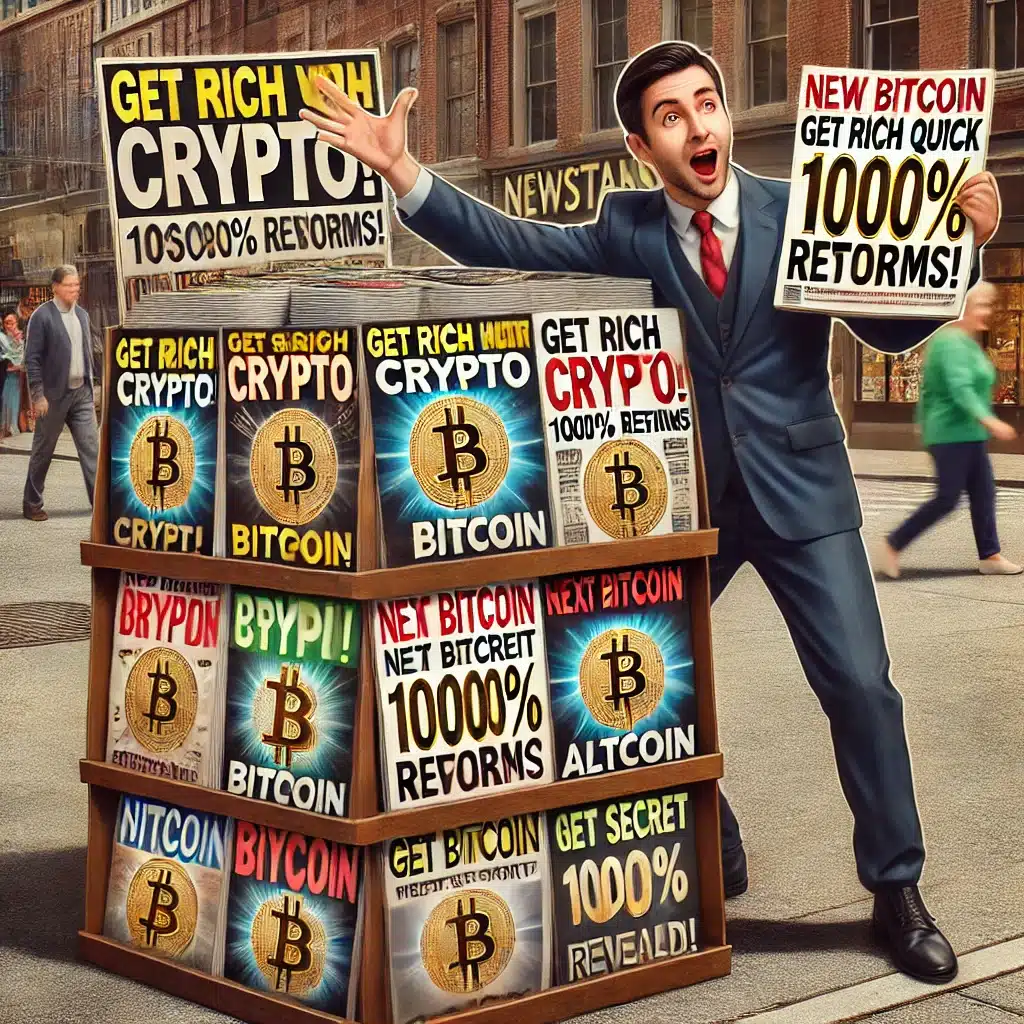

Never Trust a Crypto News Magazine Selling You the Next Hype

This article will sound a bit odd coming from a crypto news magazine itself, but truth hurts. Fact is that crypto magazines prioritize hype and speculation over substantive analysis. And most of them are...

This article will sound a bit odd coming from a crypto news magazine itself, but truth hurts. Fact is that crypto magazines prioritize hype and speculation over substantive analysis. And most of them are literally just rehashing content found elsewhere. As a result, the info given is often to be taken with big caution.

But let’s face it, we, crypto holders, live in a world where fortunes can be made or lost in the blink of an eye, which makes that the allure of sensational news and explosive investment opportunities is ever-present. Sadly enough, it’s crypto news magazines that often play a pivotal role in this ecosystem, frequently touting the next big thing in the market with promises of astronomical returns.

It doesn’t help of course that platforms like Google News (just check the headlines) or Yahoo Finance News are both riddled with these dodgy news outlets creating some kind of newsworthiness whereas they often just offer junk.

But let’s be honest, at Crypto Beat News, we also like a clickbait article here and there, but we do prefer offering some more detailed info rather then baseless speculations. An interest rate going up and down has a far bigger impact then comparing a graphic from 5 years ago. Yes, we know, X is riddled with this kind of bogus analyses.

This article delves into the pitfalls of trusting crypto news magazines that peddle hype, examining the strategies they use to capture attention and why – we repeat it again – a cautious, informed approach is essential for navigating the volatile crypto landscape.

The Allure of Speculation and Hype

Crypto magazines often emphasize sensational headlines and speculative content to capture the attention of readers. These publications frequently highlight sudden price movements, speculative investments, and bold market predictions. While this can generate a certain excitement, it also contributes to a pump-and-dump culture where short-term gains are prioritized over long-term value.

Here’s a closer look at how this plays out:

Sensational Headlines

Crypto magazines often use sensational headlines to attract readers. These headlines might promise extraordinary returns or imminent market booms, playing on the fear of missing out (FOMO). These types of headlines are designed to draw clicks and generate excitement but often lack the detailed analysis needed to support such claims. For example:

- “This Altcoin Could Skyrocket 1000% in the Next Month!”

- “Bitcoin to Reach $100,000 by the End of the Year, Experts Say”

Focus on Price Movements

Many crypto publications prioritize reporting on price movements and speculative trading. Articles frequently track the minute-by-minute changes in cryptocurrency values, creating a sense of urgency and excitement. While price tracking can be useful for traders, it often overshadows more critical aspects such as technology developments, regulatory changes, and long-term market trends. For example:

- “Ethereum Surges 20% in 24 Hours – Is This the Start of a Bull Run?”

- “Dogecoin Drops 15% After Elon Musk’s Tweet – What’s Next?”

Speculative Investments

Crypto magazines often highlight speculative investments, encouraging readers to invest in new or obscure cryptocurrencies with the promise of high returns. This can lead to a pump-and-dump scenario, where the value of a cryptocurrency is artificially inflated before being sold off by insiders. These articles usually lack comprehensive risk assessments and may not provide balanced views on the potential downsides of such investments. Examples include:

- “Invest in This New ICO and Get Rich Quick!”

- “Top 5 Altcoins That Will Explode in 2024”

Bold Market Predictions

Bold market predictions are another staple of crypto magazines. These predictions often rely on optimistic assumptions and can be misleading. Such predictions can create unrealistic expectations and may not be grounded in thorough economic or technological analysis. Examples might include:

- “Bitcoin Will Replace Fiat Currency by 2030”

- “Crypto Market to Hit $10 Trillion by 2025”

Influence of Prominent Figures

Crypto news magazines frequently amplify the voices of prominent figures in the crypto space, such as CEOs of blockchain companies, influencers, or celebrity endorsers. These figures can sway market sentiment with their statements, leading to speculative buying or selling. While these individuals can provide valuable insights (except for celebrity endorsers), their statements can also contribute to hype and speculation. Examples include:

- “Elon Musk Predicts Major Growth for Dogecoin”

- “Vitalik Buterin Says Ethereum 2.0 Will Revolutionize Finance”

Case Studies and Real Examples

- Bitconnect: Promoted heavily by various crypto news outlets, Bitconnect promised high returns through its lending program. The platform turned out to be a Ponzi scheme, collapsing in 2018 and causing significant financial losses for many investors.

- ICO Mania (2017): During the initial coin offering (ICO) boom of 2017, numerous crypto magazines hyped various ICOs, encouraging speculative investments. Many of these projects failed, leaving investors with worthless tokens.

- Dogecoin Surge: Fueled by media hype and endorsements from celebrities like Elon Musk, Dogecoin saw dramatic price increases in 2021. Despite its origins as a joke, the hype led to significant speculative trading, resulting in extreme volatile price movements.

Technology and Innovation Coverage

In addition to market speculation, many crypto magazines focus heavily on new blockchain projects, token launches, and technological advancements. While staying informed about these developments is important, the depth and quality of analysis can vary significantly. Some articles may offer genuine insights, while others merely skim the surface, failing to provide a comprehensive understanding of the technology’s implications.

Highlighting New Projects

Crypto magazines frequently cover new blockchain projects and cryptocurrency launches, aiming to inform readers about the latest innovations. These articles often emphasize the potential and vision of these projects, sometimes with an overly optimistic tone. While it’s important to learn about new projects, these articles can sometimes lack critical analysis of feasibility, team credibility, and potential risks. Examples include:

- “Introducing Project X: The Future of Decentralized Finance”

- “Revolutionary New Blockchain Could Disrupt Entire Industries”

Focus on Technological Advancements

Technological advancements in blockchain technology, such as improved consensus algorithms, scalability solutions, and interoperability features, are often covered extensively. These articles can provide valuable insights but may sometimes overstate the immediate impact of these advancements without considering the implementation challenges and adoption timelines. Examples might include:

- “Ethereum 2.0: What You Need to Know About the Upcoming Upgrade”

- “How Lightning Network is Solving Bitcoin’s Scalability Problem”

Emerging Trends

Crypto magazines also highlight emerging trends in the blockchain space, such as decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized autonomous organizations (DAOs). While these trends are exciting and offer significant potential, articles may not always fully address the risks and uncertainties associated with these new technologies. Examples include:

- “The Rise of DeFi: How It’s Changing the Financial Landscape”

- “NFTs: The Next Big Thing in Digital Art and Collectibles”

Interviews with Innovators

Interviews with blockchain innovators, developers, and industry leaders are a common feature in crypto magazines. These interviews can offer unique insights into the minds of those driving the technology forward. While these interviews provide valuable perspectives, they can sometimes be overly promotional, lacking critical questioning and balanced viewpoints. Examples might include:

- “An Exclusive Interview with Vitalik Buterin on Ethereum’s Future”

- “Inside the Mind of Charles Hoskinson: Cardano’s Roadmap Ahead”

Case Studies and Real Examples

- Ethereum’s Evolution: Coverage of Ethereum’s transition from proof-of-work to proof-of-stake (Ethereum 2.0) is a common topic. While many articles highlight the benefits, such as reduced energy consumption and improved scalability, fewer discuss the technical challenges and the timeline for full implementation.

- DeFi Platforms: The explosion of DeFi platforms like Uniswap, Aave, and Compound has been a focal point. Articles often tout the benefits of earning interest or borrowing funds without intermediaries but may underplay the risks, such as smart contract vulnerabilities and regulatory uncertainty.

- NFT Boom: The rise of NFTs in 2021 brought widespread media attention. While coverage often emphasized the potential for artists and creators to monetize their work, it sometimes overlooked issues like market volatility, environmental impact, and the speculative nature of NFT investments.

The Community and Cultural Angle

Crypto magazines often delve into the vibrant community and culture surrounding the cryptocurrency world. They highlight events, community initiatives, and emerging trends within the space. While this content can be engaging and informative, it’s essential to distinguish between genuine community-driven movements and manufactured hype designed to pump specific assets.

Crypto magazines frequently cover community events such as conferences, meetups, and hackathons. These events are portrayed as hubs of innovation, networking, and collaboration. These articles help readers stay updated on key developments and foster a sense of community, but they can also sometimes gloss over critical discussions in favor of more positive coverage. Examples include:

- “Inside Consensus: The Biggest Blockchain Conference of the Year”

- “Top Takeaways from the Latest Ethereum DevCon”

Profiles of Influential Figures

Another common feature is profiles of influential figures within the crypto space, including developers, entrepreneurs, and thought leaders. These profiles often highlight their contributions and vision for the future of cryptocurrency. While these profiles can inspire and inform, they can also border on hero-worship, sometimes failing to provide a balanced view of these figures’ controversies or the broader context of their work. Examples might include:

- “Meet Satoshi Nakamoto: The Mysterious Creator of Bitcoin”

- “Changpeng Zhao: The Man Behind Binance’s Meteoric Rise”

Cultural Movements and Trends

Crypto magazines often explore cultural movements and trends within the community, such as the push for decentralization, the rise of meme coins, or the impact of social media influencers. These articles provide insight into the ethos and values driving the community but can sometimes exaggerate the significance of these trends or overlook their potential drawbacks. Examples include:

- “The Decentralization Movement: Power to the People?”

- “How Meme Coins Like Dogecoin Are Shaping Crypto Culture”

Case Studies and Real Examples

- Bitcoin Pizza Day: Celebrated every year on May 22, Bitcoin Pizza Day commemorates the first real-world transaction using Bitcoin, where two pizzas were bought for 10,000 BTC. This event is often highlighted to showcase the growth and adoption of cryptocurrency but can sometimes be romanticized, ignoring the early financial risks involved.

- The Rise of DeFi Communities: Decentralized Finance (DeFi) communities often come together to innovate and push the boundaries of traditional finance. Articles might focus on collaborative projects and the spirit of innovation, but they may downplay the risks and the regulatory scrutiny these projects face.

- NFT Artists and Collectors: The NFT boom has created a vibrant community of artists and collectors. Coverage often highlights success stories and the democratization of art through blockchain, while potentially overlooking issues like market volatility and the environmental impact of NFTs.

The role of social media in shaping crypto culture is another significant aspect covered by magazines. Platforms like Twitter, Reddit, and Discord are pivotal in spreading information, mobilizing communities, and even influencing market movements. These articles illustrate the power of social media in the crypto space but can sometimes fail to address the potential for misinformation and market manipulation. Examples include:

- “How Twitter Influencers Are Driving the Crypto Market”

- “The Role of Reddit in the GameStop and Dogecoin Phenomena”

Crypto news magazines also highlight community-driven initiatives such as decentralized autonomous organizations (DAOs), charitable projects, and grassroots movements. These stories emphasize the positive impact of the crypto community but may not always critically assess the challenges and limitations of these initiatives. Examples include:

- “How DAOs Are Redefining Organizational Structures”

- “Crypto for Good: How Blockchain Is Revolutionizing Charity”

The Depth of Analysis: Crypto vs. Traditional Financial Magazines

Surface-Level Coverage: Crypto magazines typically provide shorter articles focused on immediate news and quick updates. This surface-level coverage can leave readers without the nuanced understanding needed to make informed decisions.

Variable Quality: The quality of analysis in crypto magazines can be inconsistent. While some publications offer in-depth research and thoughtful commentary, others rely on superficial coverage that prioritizes sensationalism over substance.

In contrast, traditional financial news magazines are known for their comprehensive and well-researched articles. They delve into the complexities of financial markets, providing in-depth economic analysis, corporate news, and investment strategies. These publications regularly feature contributions from seasoned analysts and industry experts, ensuring a higher standard of reporting.

Let’s dig a bit deeper into the differences.

Surface-Level Coverage vs. In-Depth Reporting

Crypto Magazines:Surface-Level Coverage: Many crypto magazines provide shorter articles focused on immediate news and quick updates. This often includes reporting on the latest price movements, new token launches, and market speculation.

- Example: “Bitcoin Surges 10% After Elon Musk’s Tweet – What’s Next?”

- These articles can be informative for keeping up with fast-moving market trends but often lack the depth and context needed for comprehensive understanding.

Traditional Financial Magazines:In-Depth Reporting: Traditional financial magazines are known for their comprehensive and well-researched articles. They delve into the complexities of financial markets, providing thorough analysis of economic indicators, corporate strategies, and long-term market trends.

- Example: “The Impact of Federal Reserve Policies on Long-Term Economic Growth”

- These publications often include detailed charts, historical comparisons, and expert opinions, offering a more rounded perspective.

Quality and Expertise

Crypto Magazines:Variable Quality: The quality of analysis in crypto magazines can vary widely. While some publications offer in-depth research and thoughtful commentary, others rely on sensationalism and superficial coverage.

- Example: An article promoting an obscure altcoin without a thorough examination of its fundamentals or market potential.

- The variability in quality can make it challenging to discern reliable information from mere hype.

Traditional Financial Magazines:Expert Opinions: Traditional financial magazines regularly feature contributions from seasoned analysts, economists, and industry experts. This ensures a higher standard of reporting and analysis.

- Example: “Warren Buffett’s Annual Shareholder Letter: Insights and Analysis”

- These expert contributions provide readers with well-founded insights and actionable information.

Audience and Purpose

Crypto Magazines: Crypto magazines primarily cater to enthusiasts and speculative investors. Their content is often geared towards generating excitement and engagement within the crypto community.

- Purpose: To inform readers about the latest trends, technological advancements, and investment opportunities in the crypto space.

- This can lead to a focus on short-term gains and market speculation rather than long-term investment strategies.

Traditional Financial Magazines: Traditional financial news sources appeal to professional investors, financial advisors, and individuals seeking to make informed decisions.

- Purpose: To educate readers and provide them with the tools necessary for long-term financial planning and investment.

- This focus on education and informed decision-making makes them a more reliable source of information.

Regulatory and Ethical Considerations

Crypto Magazines: Crypto magazines generally operate with less regulatory oversight compared to traditional financial publications. This lack of regulation can lead to potential biases and conflicts of interest.

- Example: A magazine promoting a cryptocurrency in which it has a financial stake without proper disclosure.

- Readers need to be cautious and critical of the information presented.

Traditional Financial Magazines: Traditional financial magazines adhere to stricter regulatory standards and journalistic ethics, ensuring a higher degree of credibility.

- Example: Transparent reporting on financial markets with clear disclosures of any conflicts of interest.

- These publications are more likely to provide balanced and unbiased information.

Audience and Purpose: Know Your Source

Crypto Magazines: Crypto publications cater primarily to enthusiasts and speculative investors. Their goal is often to generate excitement and engagement within the crypto community. While this can be beneficial for staying current with trends, it’s essential to approach such content with a critical eye.

Traditional Financial Magazines: Traditional financial news sources appeal to professional investors, financial advisors, and individuals seeking to make informed decisions. Their purpose is to educate readers and provide the tools necessary for long-term financial planning and investment. This focus on education and informed decision-making makes them a more reliable source of information.

Crypto Magazines: Catering to Enthusiasts and Speculative Investors

Target Audience:

- Crypto Enthusiasts: Individuals deeply interested in the technological and ideological aspects of blockchain and cryptocurrencies. These readers are often passionate about decentralization, innovation, and the potential of digital currencies to disrupt traditional financial systems.

- Speculative Investors: Readers looking to capitalize on the volatile nature of the crypto markets. These investors are attracted to the potential for high returns and are often willing to take significant risks.

Purpose:

- Generate Excitement:

Crypto magazines aim to create buzz and enthusiasm within the community. They often highlight the latest trends, new projects, and technological advancements to keep readers engaged and excited about the future of cryptocurrency.

- Example: “Top 10 Altcoins to Watch This Year”

- Provide Quick Updates:

Given the fast-paced nature of the crypto market, these publications prioritize timely updates on price movements, market trends, and breaking news.

- Example: “Bitcoin Hits New All-Time High Amid Market Surge”

- Promote New Projects:

Many crypto magazines focus on introducing and promoting new blockchain projects, initial coin offerings (ICOs), and decentralized applications (dApps).

- Example: “Why This New DeFi Project Could Be the Next Big Thing”

Traditional Financial Magazines: Serving Informed Investors and Professionals

Target Audience:

- Professional Investors: Individuals working in finance, such as portfolio managers, analysts, and financial advisors, who require in-depth analysis and reliable information to make informed investment decisions.

- Long-Term Investors: Readers interested in long-term financial planning, including retirees, individual investors, and those saving for future goals like education or home purchases.

Purpose:

- Educate and Inform:

Traditional financial magazines aim to provide their readers with the tools and knowledge needed to make informed decisions about their finances. This includes in-depth analysis, expert opinions, and comprehensive reports on economic trends and market conditions.

- Example: “The Impact of Federal Reserve Policies on Your Investment Portfolio”

- Offer Strategic Insights:

These publications focus on offering long-term investment strategies, detailed financial planning advice, and insights into economic policies and corporate performance.

- Example: “Top Dividend Stocks for Steady Income”

- Maintain Credibility and Trust:

Traditional financial magazines adhere to strict editorial standards and regulatory requirements to ensure the accuracy and reliability of their content. They prioritize balanced reporting and transparency.

- Example: “Understanding the Risks and Rewards of Emerging Markets Investing”

Content Differences and Editorial Approach

Crypto Magazines:

- Hype-Driven Content:

Often feature articles that emphasize potential high returns and market speculation, sometimes at the expense of balanced analysis.

- Example: “This Cryptocurrency Could Skyrocket 500% by Next Month!”

- Community-Focused:

Highlight events, community initiatives, and cultural trends within the crypto space, fostering a sense of belonging and shared purpose among readers.

- Example: “How Blockchain Conferences Are Shaping the Future of Crypto”

- Less Regulatory Oversight: May have fewer regulatory constraints, leading to potential biases or conflicts of interest, especially when promoting specific projects or tokens.

Traditional Financial Magazines:

- Research-Driven Content:

Focus on in-depth research, comprehensive analysis, and expert commentary, providing readers with a thorough understanding of financial markets.

- Example: “Analyzing the Long-Term Outlook of the Renewable Energy Sector”

- Professional Standards:

Adhere to high editorial standards and ethical guidelines, ensuring balanced reporting and transparency.

- Example: “Quarterly Market Review: Insights from Top Analysts”

- Regulatory Compliance: Subject to stricter regulatory oversight, which helps maintain credibility and trustworthiness.

Regulatory and Ethical Considerations

Regulatory Oversight: Crypto magazines generally operate with less regulatory oversight compared to traditional financial publications. This lack of regulation can lead to potential biases and conflicts of interest, making it crucial to verify the credibility of the information presented.

Transparency: Transparency is another area where crypto magazines can fall short. Some publications may be influenced by affiliations with specific crypto projects, leading to biased reporting. In contrast, traditional financial magazines adhere to stricter regulatory standards and journalistic ethics, ensuring a higher degree of credibility and transparency.

Crypto Magazines: Less Regulatory Oversight

Regulatory Environment:

- Lax Oversight:

Crypto magazines generally operate with less regulatory oversight compared to traditional financial publications. This can lead to potential biases and conflicts of interest.

- Example: A crypto magazine might promote a new cryptocurrency without disclosing that it has received compensation from the project’s developers.

- Emerging Regulations: The cryptocurrency space is still developing in terms of regulatory frameworks. As a result, the rules governing disclosures, conflicts of interest, and journalistic standards are not as robust or uniformly enforced as in traditional finance.

Ethical Standards:

- Potential for Bias:

Without strict regulations, some crypto magazines may engage in practices that could be seen as unethical, such as promoting certain tokens or projects for financial gain.

- Example: Articles that overly hype an ICO without mentioning the high risks associated with such investments.

- Transparency Issues: There may be a lack of transparency regarding affiliations, sponsorships, and financial incentives. This can make it difficult for readers to distinguish between objective analysis and paid promotions.

Traditional Financial Magazines: Stricter Regulatory Compliance

Regulatory Environment:

- Strict Oversight:

Traditional financial magazines are subject to stringent regulatory standards enforced by bodies such as the Securities and Exchange Commission (SEC) in the United States, the Financial Conduct Authority (FCA) in the UK, and other regulatory agencies worldwide.

- Example: Regulations require clear disclosure of any potential conflicts of interest and adherence to strict reporting standards.

- Established Frameworks: These publications operate within well-established regulatory frameworks that mandate transparency, accuracy, and accountability in financial reporting.

Ethical Standards:

- High Editorial Standards:

Traditional financial magazines adhere to rigorous editorial standards and journalistic ethics, ensuring balanced and unbiased reporting.

- Example: Articles are typically subject to multiple rounds of fact-checking and editorial review to maintain high quality and reliability.

- Transparency and Disclosure:

There is a strong emphasis on transparency regarding affiliations, sponsorships, and financial interests. This helps build trust with readers and ensures that content is not unduly influenced by external interests.

- Example: Clear disclosures about any financial relationships or potential conflicts of interest related to the content.

Examples of Ethical and Regulatory Practices

Crypto Magazines:

- Promotion Without Disclosure: A crypto magazine might publish a glowing review of a new altcoin but fail to disclose that the publication received tokens from the altcoin’s creators as compensation.

- Insider Trading Allegations: Without strict regulations, some individuals within the crypto space might use insider information to their advantage, promoting certain projects to inflate prices before selling off their holdings.

Traditional Financial Magazines:

- Rigorous Fact-Checking: An article on a traditional financial magazine about a new investment product would go through a thorough fact-checking process, ensuring all claims are backed by evidence and properly sourced.

- Conflict of Interest Disclosure: If a financial analyst writes about a company in which they hold shares, this conflict of interest would be clearly disclosed to readers.

Be Very Cautious and Informed

In short, while a few crypto magazines can offer valuable insights into this rapidly evolving financial industry, most lack the depth and rigor of traditional financial news sources. To make well-rounded and informed investment decisions, you should consult reputable financial news magazines alongside trusted crypto publications. This balanced approach ensures access to both the latest technological developments in the crypto space and the robust analysis typical of established financial journalism.

The golden rule is, handle all hype-driven content with skepticism. Even better, just don’t believe a word of what they are saying.

Continue Reading

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!