Is Cardano poised for a 20% rally? Charting ADA’s rise to $0.445 – Crypto News Aggregator

ADA’s Long/Short Ratio stood at the 1.034 level, indicating bullish market sentiment among traders. ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily. In this ongoing market...

- ADA’s Long/Short Ratio stood at the 1.034 level, indicating bullish market sentiment among traders.

- ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

In this ongoing market reversal, Cardano [ADA] appeared to be bullish and poised for a massive rally, driven by a potential breakout and bullish on-chain metrics.

Currently, the overall market sentiment has shifted, with major cryptocurrencies like Bitcoin [BTC] and Ethereum [ETH] experiencing significant upside momentum, and now Cardano is following suit.

Cardano price momentum

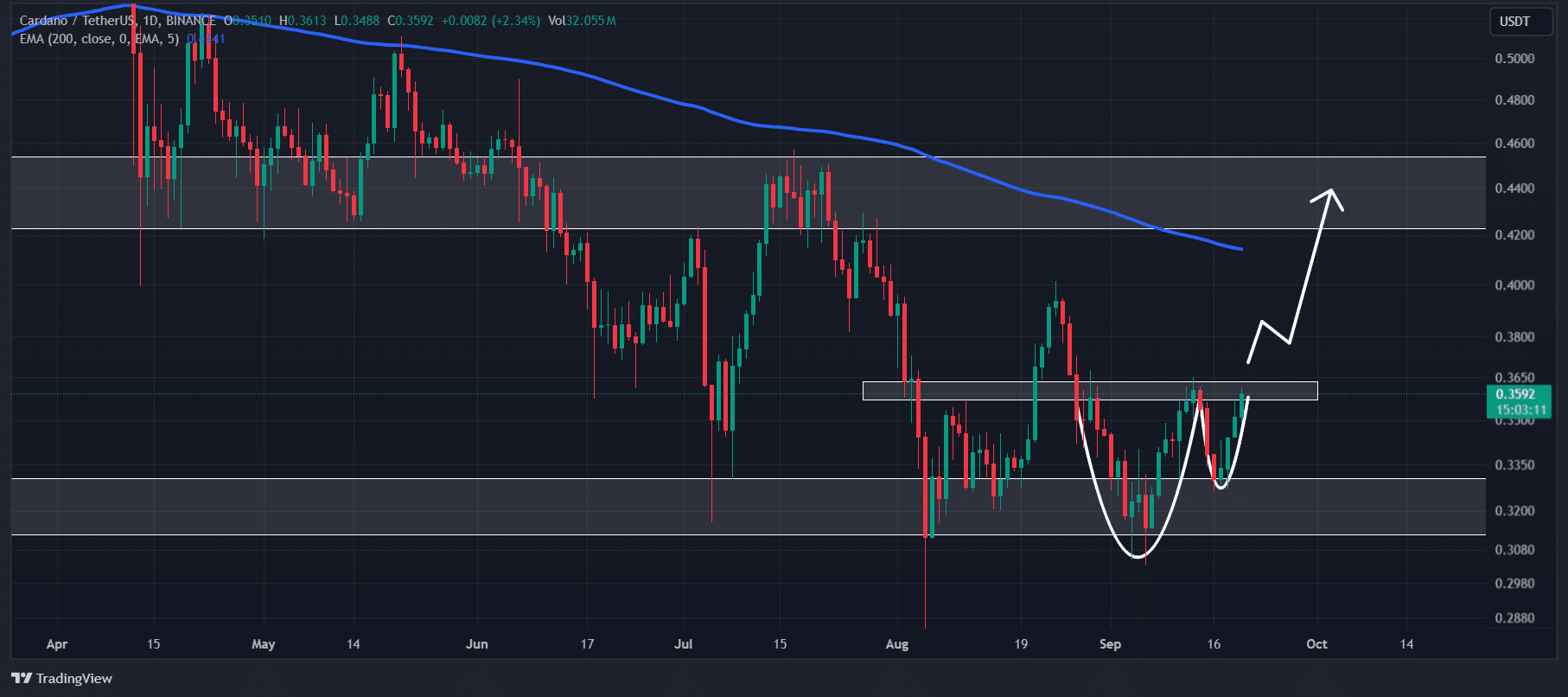

In the past three days, ADA surged more than 10%, trading near $0.36 at press time after a price surge of over 3.8% in the last 24 hours.

However, during this period, its trading volume dropped by 5%, indicating lower participation from traders and investors amid market reversal.

Despite an impressive price surge in recent days, ADA was still trading below the 200 Exponential Moving Average (EMA), indicating a downtrend on a higher frame.

The 200 EMA is a technical indicator used by traders and investors to determine whether an asset is in an uptrend or downtrend.

Despite this downtrend, ADA was near the neckline of a bullish cup-and-handle price action pattern at the $0.365 level at press time.

Historically, this level has been a point where ADA faced significant selling pressure and experienced price reversals.

If ADA breaches this neckline or resistance level and closes a daily candle above $0.367, there is a strong possibility it could rally by 20% to reach $0.445.

Bullish on-chain data

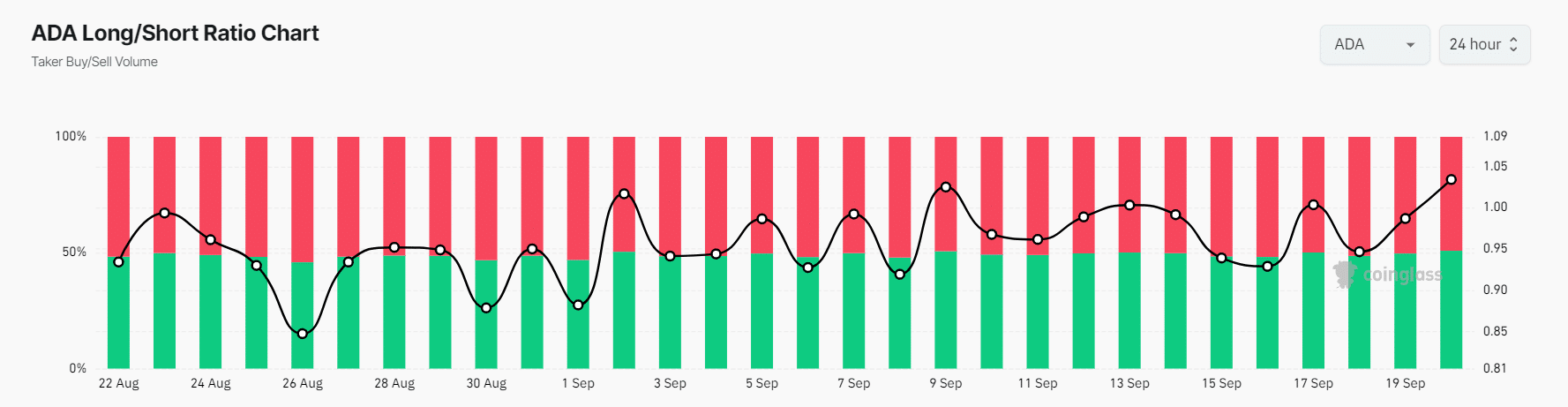

This bullish outlook is further supported by on-chain metrics. Coinglass’s ADA Long/Short Ratio was at the 1.034 level at press time, indicating bullish market sentiment among traders.

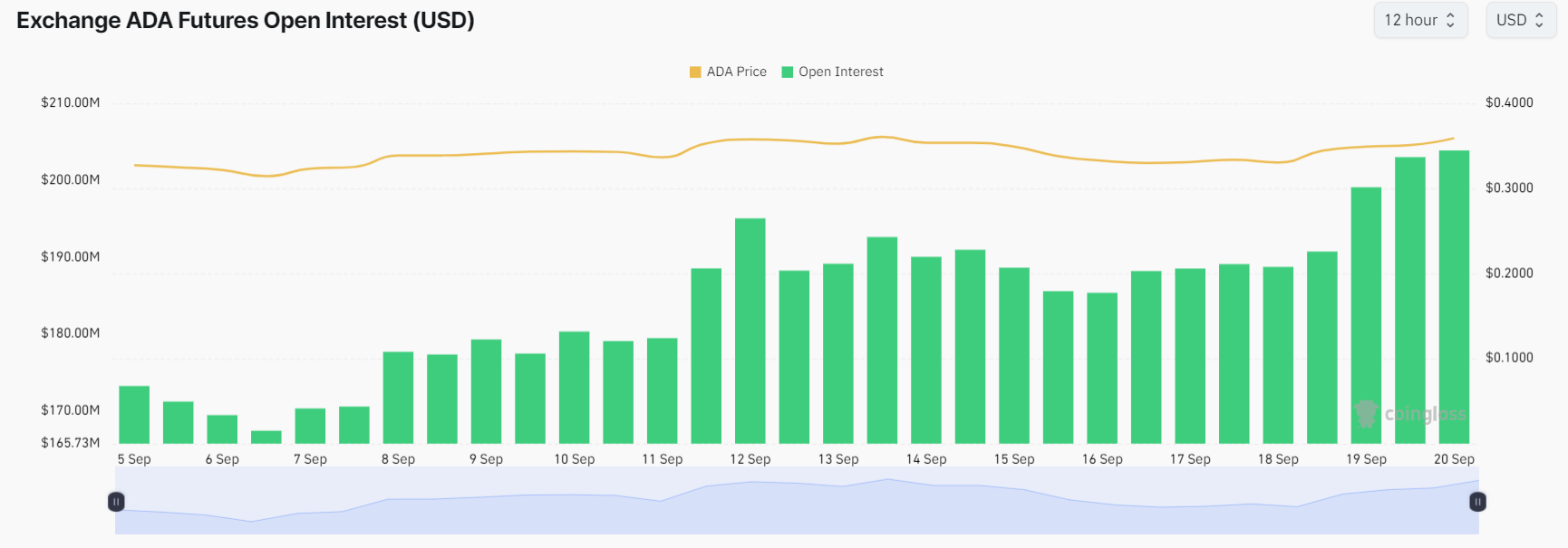

Additionally, ADA’s Futures Open Interest increased by 8.5% and continued to rise steadily.

Traders and investors often use the combination of rising Open Interest and Long/Short Ratio above 1 while building their positions.

Read Cardano’s [ADA] Price Prediction 2024–2025

As of press time, 50.84% of top traders held long positions, while 49.16% held short positions. Thus, bulls were dominating the asset.

Furthermore, ADA’s OI-Weighted Funding Rate was at +0.0096%, indicating bullish sentiment.

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!