Cardano Takes Charge Among Altcoins as Market Cap Increases – crypto.news

The post Cardano Takes Charge Among Altcoins as Market Cap Increases – crypto.news appeared on BitcoinEthereumNews.com. During the last 24 hours, the total market volume of cryptocurrencies has increased by 63.00%. Cardano was one of the top performers among...

During the last 24 hours, the total market volume of cryptocurrencies has increased by 63.00%. Cardano was one of the top performers among cryptocurrencies, as ADA holders await a recently announced new feature that could enhance the network’s smart contract capabilities.

FOMO?

Top cryptocurrencies, including Bitcoin and Ethereum, are gaining momentum in Monday’s cryptocurrency market. Over the last day, the global crypto market cap increased by 2.54% to $1.27T.

The hard fork of ADA, Vasil, is scheduled to take place on June 29, 2022. Following the upgrade, many investors started speculating on its potential upside. On June 6, ADA’s price rose by more than 14% to reach $0.64. Comparingly, ETH gained 6% over that period.

The behavior of traders during the days before a hard fork is similar to the previous years. For instance, in September 2021, the launch of the “Alonzo” smart contract platform pushed the Cardano price up by 200%. On the other hand, in March 2021, the “Mary” hard fork caused the Cardano price to skyrocket by 1,600%.

A Rise in Cardano Interest

The previous price rallies were triggered by an expansionary macro-environment, reflected in the Federal Reserve’s massive bond-buying program. At that time, interest rates were at zero, and the Fed was buying around 120 billion bonds a month.

The US central bank has started to raise interest rates due to the country’s persistent inflation. It has reduced the dollar’s liquidity, which is also likely to affect buying riskier assets such as stocks and cryptos.

The Fed’s decision to raise interest rates has caused Cardano to plummet, with the stock trading around 80% below its September 2021 peak. The broader decline also included significant bounce-offs.

Higher Price in the Days to Come?

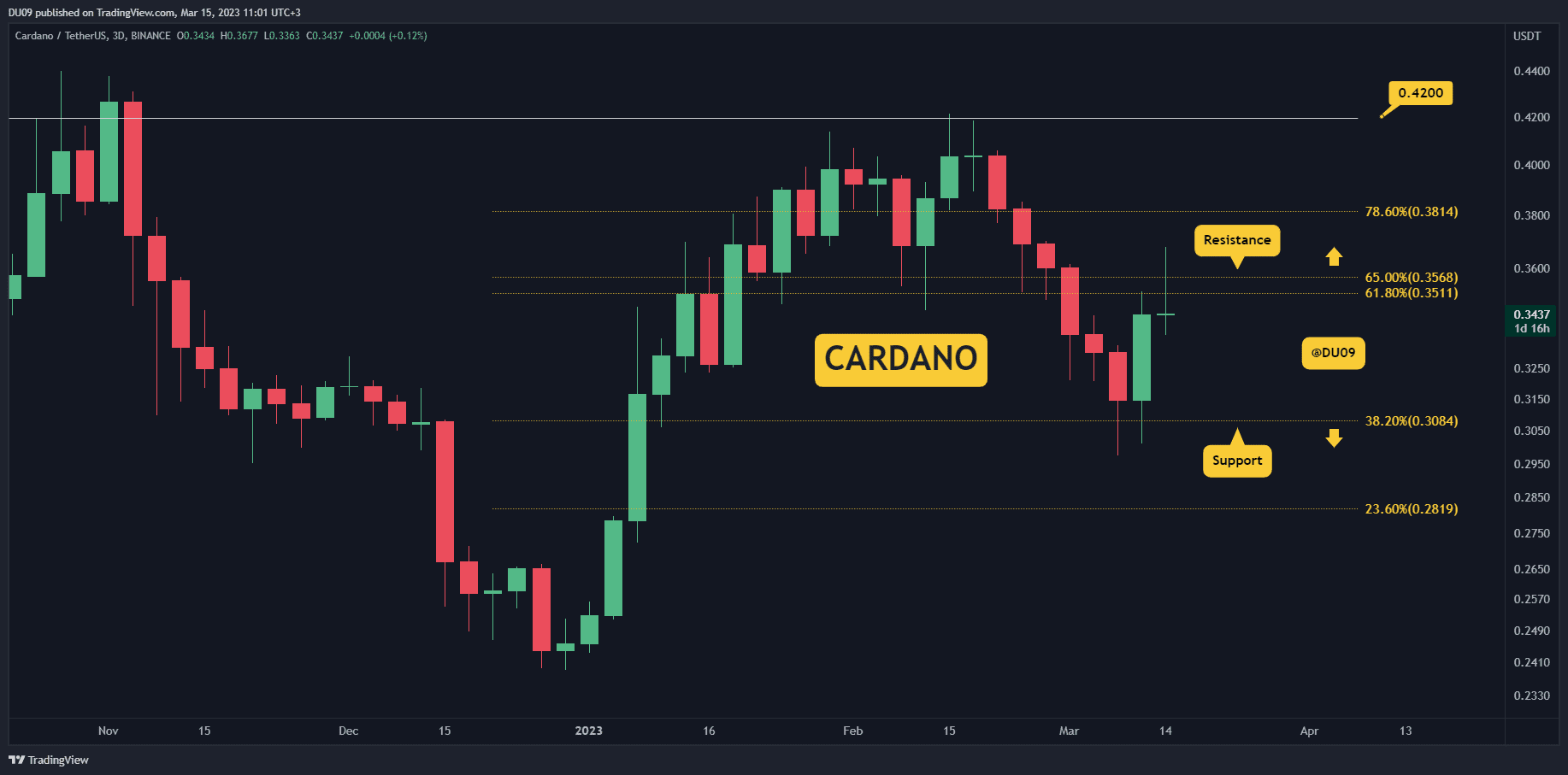

ADA is currently testing a resistance confluence consisting of a falling trendline and its 50-day moving average, a horizontal trendline, and a red wave labeled as a double bottom. If the pair can break through this resistance, it could trigger a significant move higher.

If the resistance confluence breaks above the resistance, it could trigger the double bottom formation. It is because the distance between the two lowest levels and the neckline of the descending channel adds to the target. For instance, if the price of cryptocurrencies goes up by 40% from June’s low, the target is around $0.87.

A follow-up rally could see ADA testing its 200-day moving average at around $1. However, a more likely scenario is a deeper correction, given the prevailing macro risks.

Ethereum Is Gaining, But Slower

After a relatively slow start to the week, Ethereum is back on track and is trading close to $1,900. This move is a significant step for the cryptocurrency as it shows that it can still bounce back from its lows. However, the large number of short positions sold during the recovery led to a new three-year high in the liquidations in the market.

The recovery trend for Ethereum has been strong, as it has managed to break above its 20-day moving average. It is a significant point for the digital asset, as it struggled to break the $1,700 mark. It is also the only green close in the last couple of weeks for ETH, heavily trailing Bitcoin.

Although the liquidations in the past 24 hours have eased up, they remain high. Due to the liquidations in the Bitfinex short-selling scandal, the market has been relatively calm. Today, the total liquidations in the crypto market are at around $130 million.

Source: https://crypto.news/cardano-takes-charge-among-altcoins-as-market-cap-increases/

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!