Binance delists THESE five tokens: Here’s how the market reacted – Crypto News Aggregator

Binance announced the delisting of five assets in December. The combined market cap of these assets is less than $100 million. Binance, the world’s largest cryptocurrency exchange, has announced the...

- Binance announced the delisting of five assets in December.

- The combined market cap of these assets is less than $100 million.

Binance, the world’s largest cryptocurrency exchange, has announced the delisting of five trading pairs—GFT/USDT, IRIS/USDT, KEY/USDT, OAX/USDT, and REN/USDT. This decision has sparked significant volatility in the market, with the affected tokens experiencing sharp price declines.

Scheduled for the 10th of December 2024, the delisting has reignited discussions on the impact of such moves on smaller cryptocurrencies and the broader trading community.

A closer look at price movements

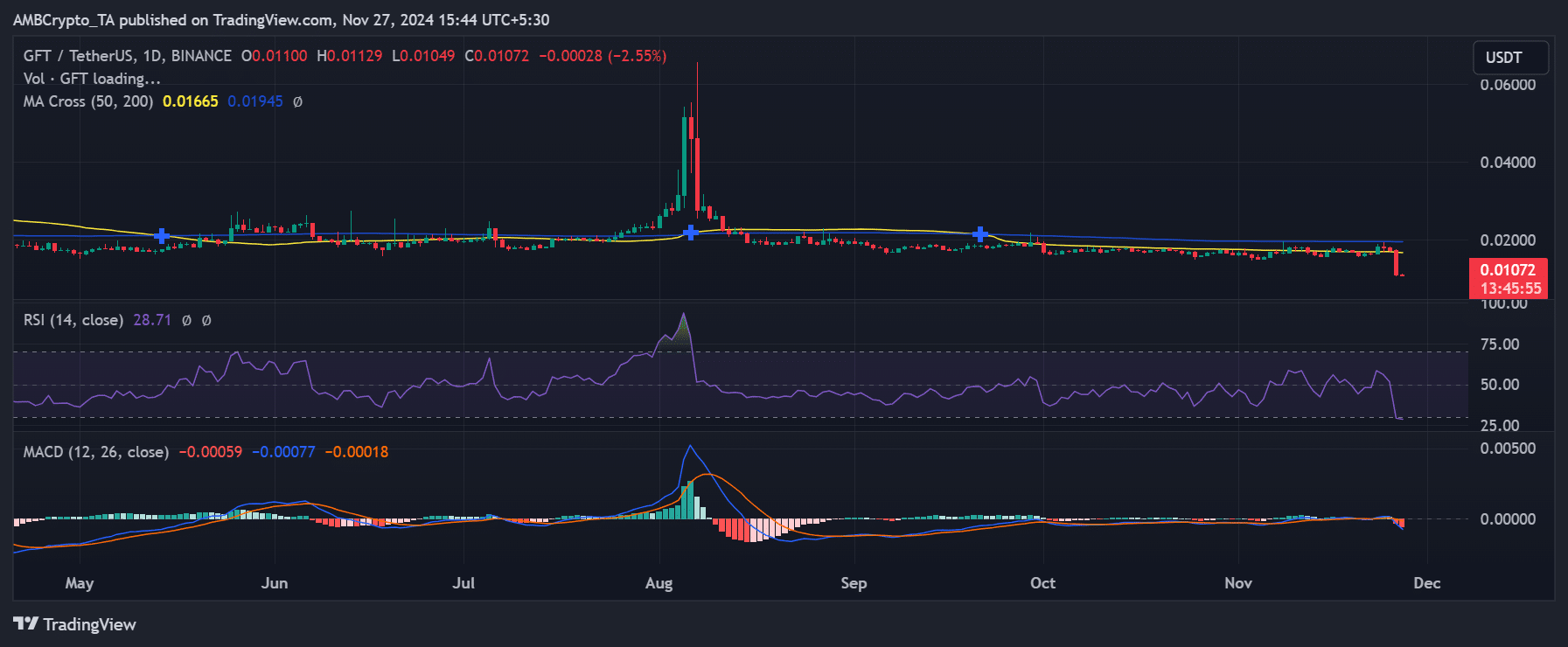

The delisting announcement has triggered significant declines across the affected tokens. GFT/USDT dropped over 30% in just 24 hours, with its RSI hovering around 28.71, indicating oversold conditions. MACD signals also pointed to a strong bearish trend, reinforcing pessimistic market sentiment.

IRIS/USDT experienced a 25% drop and was trading below its 50-day moving average. The RSI for IRIS sat at 28.74, mirroring the oversold sentiment, while the MACD showed a widening bearish divergence, further dampening short-term recovery prospects.

KEY/USDT has been hit the hardest, tumbling nearly 40% since the announcement. Its RSI plunged to 34.03, and the MACD reflected a strong bearish trajectory, leaving traders wary of a deeper decline.

OAX/USDT also faced a steep fall, shedding almost 45% of its value. The RSI for OAX was at 26.76, suggesting extreme selling pressure.

Similarly, REN/USDT lost 20% of its value, with its RSI nearing 48.44, signaling that the token is approaching oversold territory.

The broader impact of Binance’s delisting

Binance’s delisting decisions are typically based on factors like low trading volumes, failure to meet technical requirements or regulatory concerns.

While the affected tokens may be relatively small, the market reaction highlights the vulnerability of lesser-known cryptocurrencies to central exchange actions.

Historically, even larger altcoins like Ripple [XRP] and Cardano [ADA] have faced delisting or trading restrictions under specific circumstances, such as regulatory scrutiny.

What lies ahead for affected tokens?

For the delisted tokens, the immediate outlook remains bearish. The absence of Binance’s liquidity and user base will likely hinder recovery efforts.

Many traders may pivot to decentralized exchanges or alternative platforms, but the lack of visibility and reduced liquidity often create challenges for both price recovery and long-term adoption.

Post navigation

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!