Beginners guide: What is crypto yield farming and where can I do it on Cardano?

As you might know, Decentralized Finance (DeFi) has been a rapidly growing sector of the cryptocurrency industry in recent years, offering users an alternative to traditional financial systems.

As you might know, Decentralized Finance (DeFi) has been a rapidly growing sector of the cryptocurrency industry in recent years, offering users an alternative to traditional financial systems. A key feature of many DeFi protocols is the ability for users to earn a yield on their cryptocurrency holdings by providing liquidity or tokens to these protocols, a practice commonly referred to as “yield farming”. Yield farming has become increasingly popular among DeFi users due to its potential for generating higher returns compared to traditional financial systems. In this context, yield refers to the profit or return that investors can earn by providing liquidity or capital to these protocols. The ability to earn yield has made DeFi an attractive option for cryptocurrency holders looking to maximize their returns and has contributed to the rapid growth and adoption of the DeFi ecosystem.

In this blog, we will explore the concept of yield farming in DeFi and its importance to users of these protocols.

What is a crypto yield?

TLDR: Yield refers to the return or profit that investors can earn in DeFi by providing liquidity or capital to decentralized protocols or applications. It is a key factor that has contributed to the explosive growth of DeFi in recent years.

In DeFi, yield refers to the return or profit that investors can earn by providing liquidity or capital to decentralized finance protocols or applications. This can take various forms depending on the type of protocol or application, but generally, yield is earned through interest payments, rewards, or fees.

For example, in lending protocols, investors can earn yield by lending their cryptocurrency to borrowers who pay interest on their loans. The interest rate is determined by the supply and demand of the asset in the protocol, and the yield earned by the lender is a percentage of the interest paid by the borrower.

In liquidity-providing protocols, investors can earn yield by providing liquidity to a trading pair on a decentralized exchange (DEX). The investors deposit equal amounts of two different assets, such as Bitcoin and Ethereum, and earn a percentage of the trading fees paid by users who trade that pair on the DEX.

In staking protocols, investors can earn yield by staking their cryptocurrency to support the network. The investors lock up their tokens for a period of time and earn rewards paid by the network in exchange for validating transactions or contributing to the operation of the network.

What is APR?

APR (Annual Percentage Rate) on a decentralized exchange (DEX) is a key metric that represents the estimated annualized return that liquidity providers (LPs) can earn for providing liquidity to a specific trading pair on the DEX. The APR takes into account several factors, including trading fees, Staking rewards, and any incentives or Farming rewards provided by the DEX or its associated protocols.

Trading fees are a primary source of revenue for DEXs and are charged to users who execute trades on the platform. Liquidity providers who contribute to the liquidity of a trading pair are entitled to a percentage of these fees proportional to their contribution to the liquidity pool. The APR calculation considers the estimated trading volume on the trading pair to estimate the potential trading fees that LPs could earn.

Incentives or rewards offered by the DEX or its associated protocols can also impact the APR calculation. For example, a DEX may offer additional tokens or other rewards to LPs who provide liquidity to a particular trading pair. These rewards are factored into the APR calculation to provide a more accurate estimate of the potential return for LPs.

Overall, the APR on a DEX is an important metric that helps LPs understand the potential return on their investment. It takes into account several factors, including trading fees, impermanent loss, and incentives or rewards, to provide a more accurate estimate of the potential yield for LPs.

Yields on WingRiders kept simple

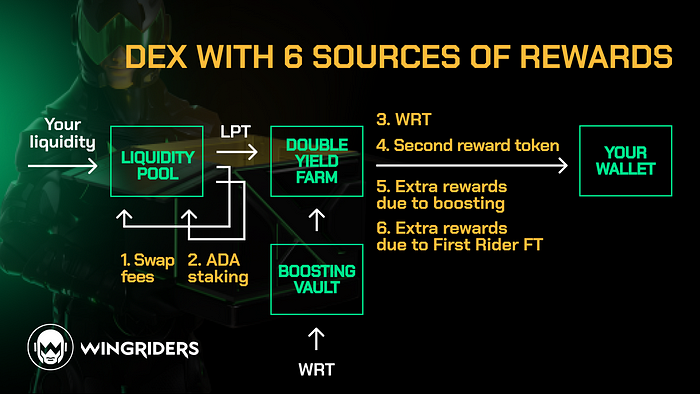

Currently, there are 6 tiers of gain opportunities on the DEX:

- Swap fees

- ADA staking

- Yield farming

- Double-yield farming

- WRT boosting

- And a special 6th tier if you hold the First Rider Fungible Token (FT). Read here What are Wingrider FTs.

At the time of writing, WingRiders has over 360 liquidity pools and, 38 farms with 10 of them being double-yield ones, and one StableSwap pool, the first in Cardano.

The opportunities to make great gains are really open to all, by simply adding liquidity, farming, and boosting the gains. You can read more about this here.

Claiming your yield

When you stake your liquidity in any pool, any fees generated from transactions are added to the pool. In the case of adding liquidity to an ADA pool, the ADA staking rewards that are generated for the total ADA of the pool being delegated to a voted stake pool are also pushed back to the liquidity pool each epoch, further increasing the value of your LPTs. Consequently, when you decide to withdraw your liquidity, the initial amount you contributed will be increased by the accumulated staking and transaction fees.

One of the key strategies for increasing your yields involves depositing your LPTs, in a farm, be it a single or double-yield farm, which offers an opportunity to gain additional rewards. However, the overall rewards you receive depend on whether the farm also offers boosting rewards.

Let’s assume that the farm does provide boosting rewards. In that case, you have two types of rewards to consider: regular gains and boosting gains. Regular rewards are gained by having your LPTs deposited in a farm for an entire epoch, which lasts for 5days from the beginning to the end of the epoch.

To claim these rewards, you can either use the “HARVEST ALL” function if you have multiple farms or simply click on the “HARVEST” button in the expandable section of the specific farm. The rewards are transferred into your wallet, or you can choose to harvest them into the Boosting vault.

Boosting rewards are sent to your Boosting vault after each epoch. To access these rewards, you need to manage the amount of WRTs you have deposited in the vault. The more tokens you have in the vault, the greater your eligibility for boosting rewards. This means that by carefully managing your WRTs, you can maximize your potential gains.

It’s worth noting that the FT you may hold also plays a role in determining the amount of boosting rewards you are eligible for. It should be noted that you don’t have to lock this FT anywhere on the platform; it just needs to be in your wallet. When we check your effective liquidity in a farm, we also check if you have an FT in your wallet at the same time, so there is no need for you to do anything other than make sure the wallet you connect to the platform contains the FT.

Also, be aware that only one FT can be applied to gain the extra boost of WRT tokens, and this will always be the highest tier FT in your wallet.

Another point to be aware of is that you need to be farming on the DEX to be eligible for the extra FT rewards.

The best way to imagine this extra reward is that you will be eligible for all the rewards at the stated rates on the UI even without the FT. But with the FT in your wallet at the snapshot time, you will get higher boosting rewards.

Hopefully, now it is clear how all possible gains on WingRiders are received. For a more detailed advanced explanation of how to put this into practice, using WingRiders, to maximize yields, we cover it all in this article.

Delegate Your Voting Power to FEED DRep in Cardano Governance.

DRep ID: drep12ukt4ctzmtf6l5rj76cddgf3dvuy0lfz7uky08jfvgr9ugaapz4 | We are driven to register as a DRep by our deep dedication to the Cardano ecosystem and our aspiration to take an active role in its development, ensuring that its progress stays true to the principles of decentralization, security, and community empowerment.DELEGATE VOTING POWER!